Jakarta, 2 March 2024 – In line with commitment for continuous innovation in providing quality services and consistently supporting the local business ecosystem, BCA launched the BCA Merchant application. This application is designed as a leading solution to empower businesses of all sizes, including Micro, Small, and Medium Enterprises (MSME).

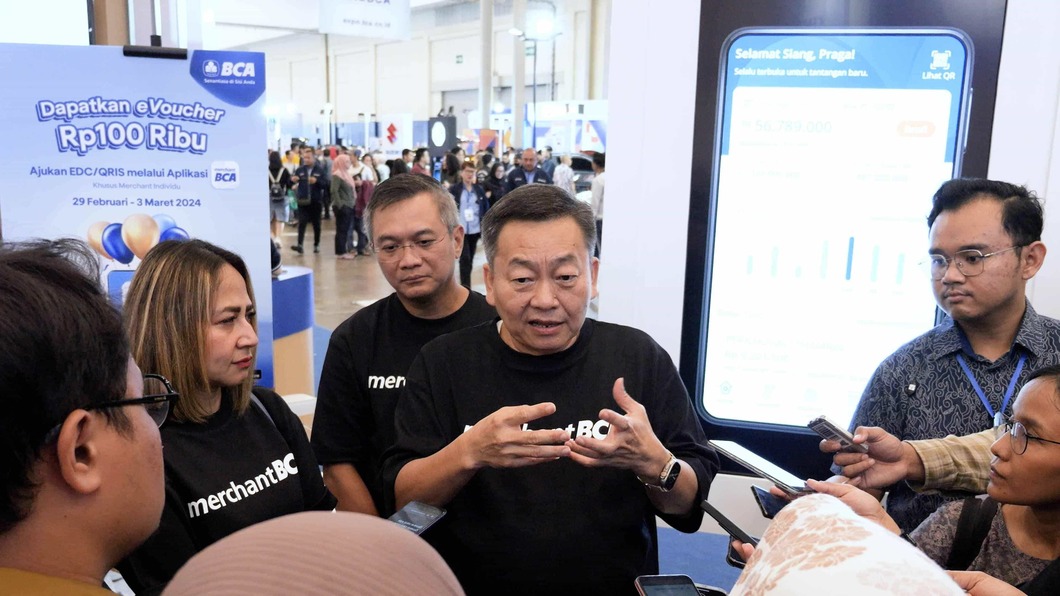

The launch of the BCA Merchant application was held along with BCA Expoversary 2024 at ICE BSD, Tangerang. The event was attended by BCA Vice President Director Armand W. Hartono, BCA Director Santoso, Development of Cooperation Solutions and BCA EVP of Banking Transactions Hendra Tanumihardja, and BCA EVP of Corporate Communication and Social Responsibility Hera F. Haryn.

The BCA Merchant App is a comprehensive tool for merchant partners to simplify financial transactions, improve operational efficiency, and support business growth. Notable features of the BCA Merchant application include:

- Merchant Care

Merchant Care provides 24/7 information and solutions related to EDC or QRIS. Additionally, Merchant Care also provides easeness for merchants to make reports when facing problem via the application, to be followed up by BCA. This is expected to provide optimal support to users and ensure the needs and questions of merchant partners can be responded to.

- User Management

In BCA Merchant application could also easily manage users for various functions starting from super admin (owner), admin, finance, and access authorization for cashier users.

- Real-time Transaction Notifications|The BCA Merchant Application provides a user-friendly platform to manage financial transactions smoothly, from checking BCA EDC & QRIS transactions in real-time to monitoring revenue in real-time. Merchant partners can now see a comprehensive overview of their financial transactions, allowing them to make informed decisions. Transaction reports can be downloaded and sent to email for easy reporting if necessary.

- EDC or QRIS Static Submission

The BCA Merchant Application also features EDC or static QRIS submission, thus increasing the convenience and ease for merchant partners to obtain transaction devices.

“At BCA, we believe in the power of innovation to drive business progress and national economic growth. The BCA Merchant App is a proof of our commitment in providing leading-edge solutions that meet the evolving needs of entrepreneurs or merchant partners. With the presence of the BCA Merchant application, we hope to contribute to the development and empowerment of merchant partners, including MSMEs in Indonesia,” explained BCA Vice President Director Armand W. Hartono.

For information, merchant partners who are interested in utilizing the benefits of the BCA Merchant application, the application be downloaded via Google Play Store or App Store. For further information as well as the registration mechanism, please visit bca.id/merchantbca

“BCA always strives to provide the best service for all our beloved customers, including business customers. Therefore, we are constantly innovating not only in the business-to-consumer (B2C) side but also in the business-to-business (B2B) segment. In addition to the BCA Merchant application, we also provide a variety of banking and credit solutions that enable MSMEs and local entrepreneurs to grow and develop with BCA, such as EDC with touch screen features to the BCA Bangga Lokal program,” said BCA Director Santoso.

BCA also has a 100% MDR cashback program that can be enjoyed by individual merchants in the micro business category (UMI). This program applies to new and existing merchants who actively use the BCA Merchant application. Further information about the 100% MDR cashback program can be found at bca.id/cashbackmdr.

***

About PT Bank Central Asia Tbk (as of 31 December 2023)

BCA is one of the leading commercial banks in Indonesia with the core business of transaction banking. BCA also offers a full range of financial services in consumer, SME, commercial and corporate segments. As of December 2023, BCA has the privilege of serving more than 38 million customer accounts, processing around 82 million of daily transactions through a network of 1,258 branches; 19,047 ATMs as well as the 24-hour internet & mobile banking systems; supported by 24/7 Halo BCA contact center. BCA’s presence is complemented by a number of subsidiaries focusing on vehicle financing, sharia banking, securities, general and life insurance, digital bank, remittance as well as venture capital business. BCA is committed to building lasting relationship with customers, putting people first, and making positive impact on society at large. With around 27,000 employees, BCA's vision is to be the bank of choice and a major pillar of the Indonesia economy.

PT BANK CENTRAL ASIA TBK

Group Corporate Communication and Social Responsibility - CSR

Corporate Communication

Address : Jl. MH Thamrin No. 1

Menara BCA Lt. 22

Jakarta Pusat 10310

Telephone : (021) 2358-8000

Fax : (021) 2358-8339

E-mail : corcom_bca@bca.co.id