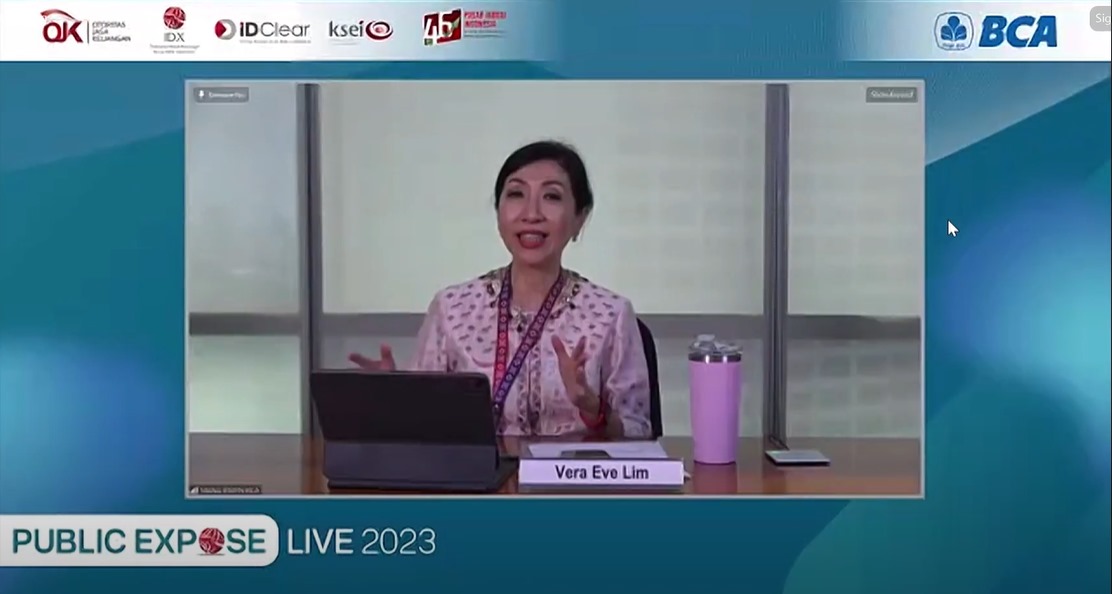

Jakarta, 29 November 2023 - PT Bank Central Asia Tbk (IDX: BBCA) today held a public expose as part of its commitment to consistently provide transparent information to its public shareholders. The public expose was attended by BCA Director Vera Eve Lim, BCA Corporate Secretary Raymon Yonarto, BCA EVP of Corporate Communication and Social Responsibility Hera F. Haryn, and BCA SVP of Investor Relations Rudy Budiardjo.

At the public expose, the Bank disclosed that business growth remained positive. BCA recorded strong loan growth across all segments, from SMEs, corporate, to consumer loans. BCA’s loans also grew above the industry average. This is consistent with the strong resilience of the national economy and controllable inflation, even amid geopolitical and global economic uncertainties.

BCA also recorded sustainable growth in transaction banking, thanks to ongoing innovation. This is in accordance with the Bank's dedication to ensuring the safety and convenience of diverse customer segments when conducting transactions. In line with this, BCA's total current and savings account (CASA) funds continue to grow and support the overall growth of third-party funds. BCA's liquidity is well-positioned to sustainably increase loan growth.

“BCA is optimistic about continuing to drive credit distribution across various economic sectors while maintaining a cautious approach. In the consumer segment, we have once again organized two expos in 2023. From these events, we were able to gather a total application of Rp46 trillion in mortgages and vehicle loans, marking an increase of more than 50% compared to 2022. So far in 2023, SMEs have booked the highest credit compared to other BCA loan segments. In the third quarter, the Bank organized 'BCA UMKM Fest 2023,' which successfully engaged 1,400 MSMEs, and 'BCA Wealth Summit 2023,' which recorded more than 900,000 visitors in just two weeks. Moreover, the integration of Welma into the myBCA application enables customers to start investing from Rp10,000 for mutual funds and Rp1,000,000 for FR bonds. With these affordable investment options, we hope that investment can be accessible to the wider public, especially the younger generation” explained Vera Eve Lim.

With the support of various business lines, BCA posted net profit growth of 25.8% YoY to Rp36.4 trillion in the first nine months of 2023. As of September 2023, BCA's total loans rose by 12.3% YoY to Rp766.1 trillion. On the funding side, total third party funds rose 6.2% YoY to Rp1,089 trillion as transaction volume grew, increasing CASA. BCA's total transaction volume rose 26.8% YoY to reach 22 billion transactions in the first nine months of the year. The mobile banking channel registered the highest growth in transaction volume, growing by 43.4% YoY.

“We are dedicated to consistently reinforcing the incorporation of environmental, social, and governance (ESG) values. This commitment involves expanding our sustainable financing loan portfolio and adopting environmentally friendly corporate practices. The disbursement of sustainability-linked loans has grown by 11.9% YoY to Rp193.2 trillion, accounting for 25.0% of total loans as of September 2023. BCA remains steadfast in its commitment to making a positive impact on society through diverse CSR programs as part of the Bakti BCA initiative,” concluded Vera Eve Lim.

Recently, as part of the Bakti BCA’s CSR program, the Bank conducted a green initiative by planting 38,500 trees in six villages in Denbukit, Buleleng, Bali. This initiative was in collaboration with the Indonesian Ministry of Finance to support the issuance of Retail Government Sukuk series 011 (ST011) or Green Sukuk by the government. BCA played a crucial role as one of the retail sukuk distribution partners. Alongside the tree-planting initiative, the Bank organized a financial education program titled “Investing with Impact: Empowering Youth for Green Indonesia.” The program was attended by students from Udayana University Bali and BCA customers. Additionally, Bakti BCA supported the implementation of export trade training for 60 selected SMEs in Semarang and Yogyakarta. This training was a collaborative effort with the Indonesian Ministry of Trade and included SME participants from BCA's assisted tourism villages, namely Doesoen Kopi Sirap and Kampung Batik Gemah Sumilir.

BCA Recorded Strong Loan Growth across All Segments – BCA Director Vera Eve Lim during her presentation at BCA Public Expose on Wednesday (29/11). PT Bank Central Asia Tbk (IDX: BBCA) today held a public expose as part of its commitment to consistently provide transparent information to its public shareholders. At the public expose, the Bank disclosed that business growth remained positive. BCA recorded strong loan growth across all segments, from SMEs, corporate, to consumer loans.

*****

About PT Bank Central Asia Tbk (as of 30 September 2023)

BCA is one of the leading commercial banks in Indonesia with the core business of transaction banking. BCA also offers a full range of financial services in consumer, SME, commercial and corporate segments. As of September 2023, BCA has the privilege of serving nearly 39 million customer accounts, processing around 81 million of daily transactions through a network of 1,252 branches; 18,705 ATMs as well as the 24-hour internet & mobile banking systems; supported by 24/7 Halo BCA contact center. BCA’s presence is complemented by a number of subsidiaries focusing on vehicle financing, sharia banking, securities, general and life insurance, digital bank, remittance as well as venture capital business. BCA is committed to building lasting relationship with customers, putting people first, and making positive impact on society at large. With around 25,000 employees, BCA’s vision is to be the bank of choice and a major pillar of the Indonesia economy.

PT BANK CENTRAL ASIA TBK

Group Corporate Communication and Social Responsibility - CSR

Corporate Communication

Address :

Jl. MH Thamrin No. 1

Menara BCA Lt. 22

Jakarta Pusat 10310

Telephone : (021) 2358-8000

Fax : (021) 2358-8339

E-mail : corcom_bca@bca.co.id