Jakarta, 19 February 2021 – PT Bank Central Asia Tbk (BCA) is collaborating with an electronic-based money lending institution or peer-to-peer (P2P) lending fintech targeting the agricultural sector, PT iGrow Resources Indonesia (iGrow).

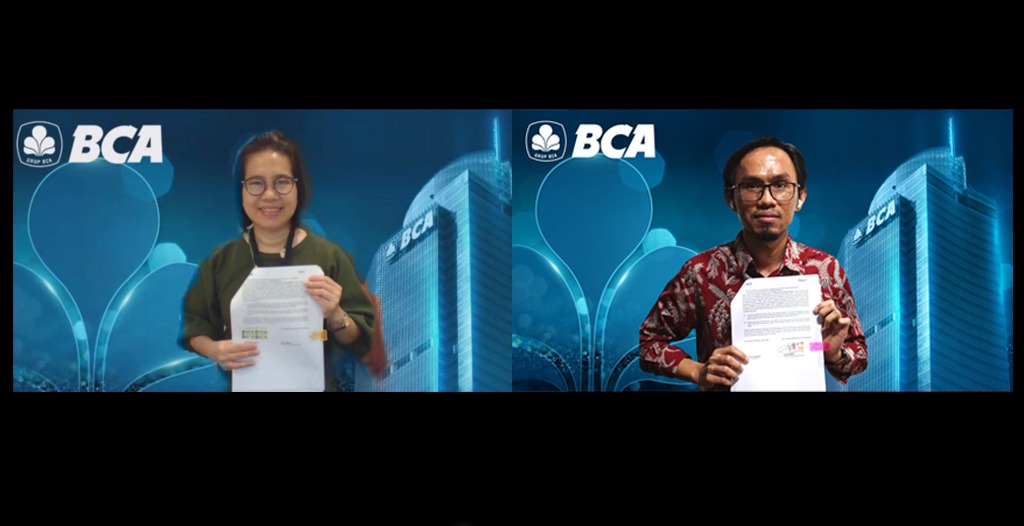

The signing of the cooperation agreement was carried out by SVP Commercial & SME Business of BCA Elvriawati Tumewah and Chief Business Development Officer iGrow Jim Oklahoma, on Friday (19/02). This collaboration demonstrates BCA's commitment to supporting the agricultural sector as a driving force for the Indonesian economy, as well as BCA's efforts to expand the market in the digital segment.

“The agricultural sector is one of the pillars of Indonesia's food stability. Therefore, BCA observes the need for support from Indonesian farmers in the midst of a pandemic. To increase production, farmers will be able to apply for People's Business Loans (KUR) through an application via cellphone. This support will be facilitated by iGrow as a leading fintech in the agribusiness sector with a large portfolio and broad understanding of agribusiness. Later, through this collaboration, BCA can finance farmers from remote areas of Indonesia without any distance constraints,” said Freddy Iman, EVP Commercial & SME Business of BCA.

The channeling scheme in this collaboration will include cooperation in providing credit facilities in the form of Micro KUR and Small KUR. Financing will be focused on debtors engaged in the agribusiness sector covering all industries related to agriculture, including horticulture, forestry, fisheries, plantations, livestock, and food crops with a maximum distribution of up to IDR200 million per loan. BCA and iGrow will also provide relief for debtors, by not requiring collateral and not charging any fees in applying for credit.

Established in 2014, iGrow has funded more than IDR286 billion in financing for Indonesian agricultural businesses. This makes iGrow the largest and the first P2P business in the agriculture sector in Indonesia. The top five commodities that receive financing include freshwater fisheries, seeding and cultivation of corn, fruits, laying hens, and red ginger.

Jim Oklahoma welcomed this collaboration, “The support provided by BCA worth IDR25 billion through this channeling scheme will benefit agricultural sector players who are BCA debtors. Hopefully, this cooperation can continue and facilitate more farmers who need capital assistance.”

For information, as of December 2020, BCA has distributed KUR to the agriculture and plantation sectors reaching IDR65.4 billion. Through this cooperation, of course, lending will increase and support economic movement.

"We are optimistic that the collaboration with iGrow can have a positive impact on the development of the agricultural sector in Indonesia. This collaboration can also be an attractive opportunity for agricultural sector players who are BCA debtors to be able to develop their business through easy capital loans,” concluded Freddy.

BCA Collaborates with iGrow to Facilitate KUR to the Agriculture Sector - SVP Commercial & SME Business of BCA Elvriawati Tumewah (left) and Chief Business Development Officer iGrow Jim Oklahoma (right) shortly after signing the cooperation agreement on Friday (19/02). This collaboration demonstrates BCA's commitment to supporting the agricultural sector as a driving force for the Indonesian economy, as well as BCA's efforts to expand the market in the digital segment. This support will be facilitated by iGrow as a leading fintech in the agribusiness sector with a large portfolio and broad understanding of agribusiness.

***

About PT Bank Central Asia Tbk (as of 31 December 2020)

BCA is one of the leading commercial banks in Indonesia with the core business of transaction banking. BCA also offers a full range of financial services in consumer, SME, commercial and corporate segments. As of December 2020, BCA has the privilege of serving 25 million customer accounts, processing around 32 million of daily transactions through a network of 1,248 branches; 17,623 ATMs as well as the 24-hour internet & mobile banking systems; supported by 24/7 Halo BCA contact center. BCA’s presence is complemented by a number of subsidiaries focusing on vehicle financing, sharia banking, securities, general and life insurance, digital bank, remittance as well as venture capital business. BCA is committed to building lasting relationship with customers, putting people first, and making positive impact on society at large. With more than 24,000 employees, BCA's vision is to be the bank of choice and a major pillar of the Indonesia economy.

For more information, please contact :

PT BANK CENTRAL ASIA TBK

Corporate Secretariat Division – Corporate Communication Sub Division

Public Relations Bureau

Address : Jl. MH Thamrin No. 1

Menara BCA Grand Indonesia 20th Floor

Jakarta Pusat 10310

Phone : (021) 2358-8000

Fax : (021) 2358-8300

E-mail : humas@bca.co.id