Jakarta, 31 October 2023 – As part of the company’s efforts to foster the growth of MSMEs through export activities, PT Bank Central Asia Tbk (BCA) has established a strategic partnership with PT Indonesia Bisa Ekspor, a digital platform and community for young exporters. This partnership has been formed to provide opportunities for assisted exporters to access financing via BCA’s working capital loans (KUR).

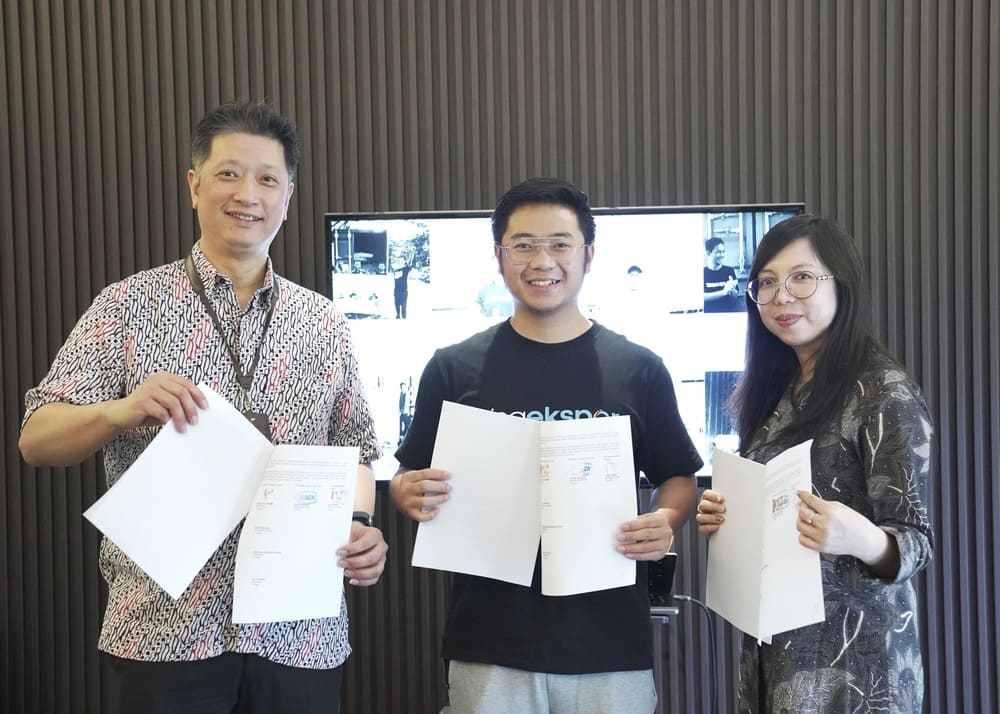

The partnership agreement for financing MSME players in the export sector was signed by BCA SVP of Business Commercial & SME Tjoeng Haryanto, President Director of PT Indonesia Bisa Ekspor Julio Ekspor, and Director of PT Aman Cermat Cepat (KlikA2C) Bong Elysabet on Monday (30/10) in Jakarta.

“In line with BCA’s commitment to promoting the expansion of local product exports, we will make the KUR available to all MSME sectors. We firmly believe that by simplifying access to financing for assisted exporters, we can empower them to compete and successfully enter the global market,” explained Tjoeng Haryanto.

In order to stimulate the export growth of Indonesia’s flagship products, BCA offers loans of up to Rp500 million at competitive interest rates, starting from 6% effective per annum. The program also offers other benefits, including the elimination of administration and provisioning fees, which enables assisted exporters to access more affordable financing.

“Every year, our exporters are gaining more experience, which has opened up greater prospects for them to grow their businesses on the international level. The support provided by BCA, especially in terms of facilitating access to financing, has played a pivotal role in fueling their achievements,” stated Julio Ekspor.

One significant benefit of BCA’s KUR is the quick and seamless application process, facilitated through their strategic partnership with KlikA2C, a channeling institution. This partnership simplifies the financing application process for exporters, enabling them to focus more effectively on expanding their businesses.

BCA is firmly committed to promoting the expansion of local products and elevating national exports. Collaborating with Indonesia Bisa Ekspor represents our first step towards making a greater positive impact on exporters and the Indonesian economy as a whole. Through this initiative, BCA seeks to promote local businesses and demonstrate support for the Indonesian economy.

“We are optimistic that the assisted exporters can compete in the global market. We will remain committed to supporting them in promoting Indonesia’s flagship products on the international stage. This collaborative effort is expected to sustain the continuous growth of the Indonesian export industry, thereby strengthening Indonesia’s position in the global export market,” concluded Tjoeng.

As a matter of information, BCA has actively supported MSMEs by implementing various initiatives. This includes export trade training, which was attended by 60 MSMEs in Yogyakarta and Semarang. Furthermore, BCA has successfully organized BCA UMKM Fest since 2021, with approximately 1,400 MSMEs participating to promote their flagship products.

BCA and Indonesia Bisa Ekspor Team Up to Disburse KUR to Local Exporters - BCA Senior Vice President of Business Commercial & SME Division Tjoeng Haryanto (left) with President Director of PT Indonesia Bisa Ekspor (center) and Director of PT Aman Cermat Cepat (KlikA2C) Bong Elysabet, after signing the partnership agreement for the disbursement of working capital loans (KUR) to Indonesian MSMEs in the export sector on Monday (30/10). BCA offers competitive interest rate loans starting from 6% effective per annum, as well as the waiver of administrative and provisioning fees to support the growth of local product exports, enabling them to compete in the global market.

*****

About PT Bank Central Asia Tbk (as of 30 September 2023)

BCA is one of the leading commercial banks in Indonesia with the core business of transaction banking. BCA also offers a full range of financial services in consumer, SME, commercial and corporate segments. As of September 2023, BCA has the privilege of serving nearly 39 million customer accounts, processing around 81 million of daily transactions through a network of 1,252 branches; 18,705 ATMs as well as the 24-hour internet & mobile banking systems; supported by 24/7 Halo BCA contact center. BCA’s presence is complemented by a number of subsidiaries focusing on vehicle financing, sharia banking, securities, general and life insurance, digital bank, remittance as well as venture capital business. BCA is committed to building lasting relationship with customers, putting people first, and making positive impact on society at large. With around 25,000 employees, BCA’s vision is to be the bank of choice and a major pillar of the Indonesia economy.

PT BANK CENTRAL ASIA TBK

Group Corporate Communication and Social Responsibility - CSR

Corporate Communication

Alamat : Jl. MH Thamrin No. 1

Menara BCA Lt. 22

Jakarta Pusat 10310

Telepon : (021) 2358-8000

Fax : (021) 2358-8339

E-mail : corcom_bca@bca.co.id