Fraud to customers often happens when personal data are unknowingly shared to fraudsters. There are types of data that cannot be shared at all and there are data that can only be shared to certain parties. What are those data? Let’s get to it.

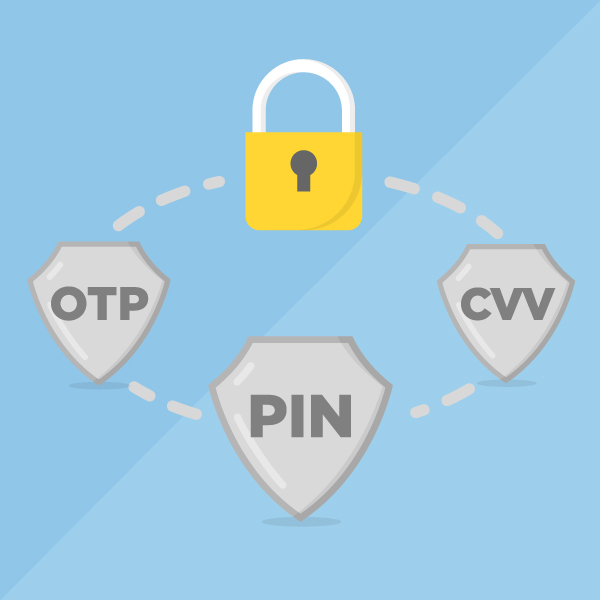

STOP! DO NOT SHARE THIS DATA TO ANYONE

Your personal data is yours. Never ever give it to anyone, including bank employees.

- PIN (Personal Identification Number) is a secret number code to log in to your account.

- OTP (One Time Password) is a dynamic password sent by the bank or online commerce websites via SMS or email, asking for your permission to access your account such as debiting money or phone credits.

- CVV (Card Verification Code) or CVC (Card Verification Code) is the last 3-digit number on the back of your credit card. It is usually located on the signature section of a credit card.

DO NOT SHARE YOUR PERSONAL DATA ON SOCIAL MEDIA

Banks may need some data for your banking purposes. But, if you share it with the wrong people, it would increase the risk of fraud. For instance, stolen customers’ data can be used by fraudsters to control your account. Do not share your personal data on social media. Do not share these data to other people, except people that you truly trust or official bank employees.

- ATM card number

- Credit Card number

- Mother’s name

- Date of birth

- Bank account number

- Phone/mobile number

In some frauds, such as account take over, email phishing, fictitious call center, etc., the above personal data are often used by fraudsters to obtain your OTP, PIN or CVV as the “key” to break into your account.

If you notice anything suspicious, call Halo BCA at 1500888.