Fraudsters look for a lot of ways to get into your account. One of them is by getting your secret banking information. Recently, there was a fraud impersonating OneKlik.

One of the recent frauds using OneKlik is when the fraudster pretends to be an officer of an e-commerce platform and offers you and other BCA customers a chance to win cash money prizes. The fraudster would say the prize can only be claimed by you transferring a sum of money via OneKlik.

With psychological manipulation, the fraudster may convince his victim to transfer money by doing the following things:

- Requesting your ATM card numbers for the purpose of transferring the cash prize.

- He would ask you to press the OneKlik registration notification on your phone to direct you back to the BCA mobile app.

- After that, you would be asked to log in to your BCA mobile by inserting the access code.

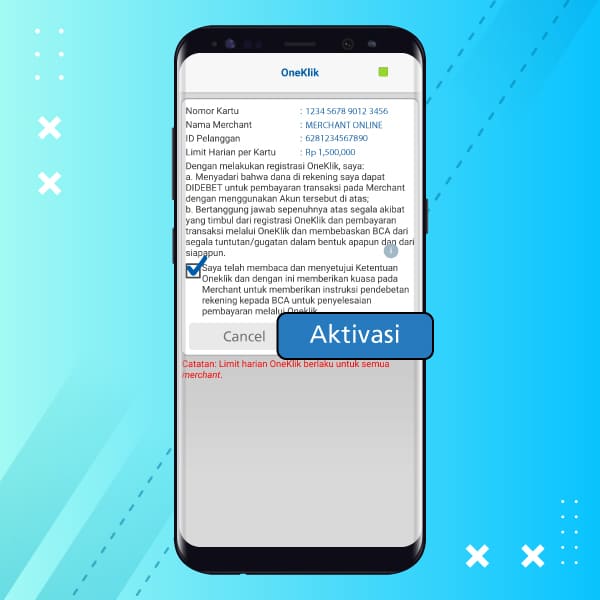

- Finally, you would be asked to confirm and agree with OneKlik’s terms and conditions, finishing it up by inputting your m-BCA PIN to activate OneKlik

Unknowingly, when the victim did step 1 (giving ATM card numbers), the fraudster is registering OneKlik on the e-commerce platform, and then guided the victim to do steps 1 to 4 above.

Once OneKlik is activated, the fraudster can immediately make transactions using the victim’s OneKlik account that was connected to the fraudster’s e-commerce account!

Also, fraudsters sometimes carry out phishing by asking victims to open a link that will be redirected to a fake OneKlik website. On that site, they will ask victims’ personal data, like ATM card numbers, m-BCA access code, m-BCA PIN, and many others.

In the above case, the fraudster is targeting a particular BCA customer who does not understand how OneKlik works and victims who are unaware when making OneKlik transaction or registration on his BCA mobile. The next thing he knows, the money is gone.

Learn About OneKlik to Keep You Safe

- OneKlik is not a money transfer method. Instead, it is a payment method via merchant website or apps. For example, when you shop at Blibli.com or top-up a Gopay credit, payments are made within the merchant site or app. So, there is no personal transfer method using OneKlik or by asking for your ATM card numbers or OTP codes.

- Never share your personal bank data, like ATM card numbers or OTP code, to anyone. Not even to those claiming from official institutions or prospective online buyers. You must keep your ATM card numbers, OTP code, m-BCA access code, and m-BCA PIN to yourself, do not share them to anyone for any reason. If you had never made any payment and someone suddenly came to ask for your personal data, you can be sure that it is a scam.

- OneKlik has improved its service features to ensure convenience and safety of your transactions.

- OneKlik merchant activation on the website no longer requires the OTP code sent via SMS, but directly via BCA mobile. You need to login to BCA mobile to confirm the OneKlik account registration. So, be cautious if you receive a OneKlik registration activation link on the merchant app.

- You can manage the daily transaction limit in all OneKlik merchant through BCA mobile. Login to BCA mobile, open the m-Admin feature, click Atur OneKlik, open the active account, and choose Atur Limit (maximum limit is Rp3.000.000 per day).

- You can temporarily block, unblock, or delete your OnkeKlik active account in BCA mobile. Login to BCA mobile, open m-Admin feature, choose Atur OneKlik, choose the account you wish to temporarily block or delete. Same goes when you want to unblock it.

Setting up OneKlik using BCA mobile on your smartphone is a piece of cake. Use OneKlik for a better shopping experience with only one click from merchants’ website or app, and set your OneKlik account using mobile BCA for the safest way.

Always protect your personal data, and do not get tempted by any fraudster’s sweet promises. Learn more ways of keeping your account safe at www.bca.co.id/awasmodus.

#DatamuRahasiamu #CariTahuBiarAman