Be Alert If Your Debit or Credit Card is Swiped Twice by Cashiers

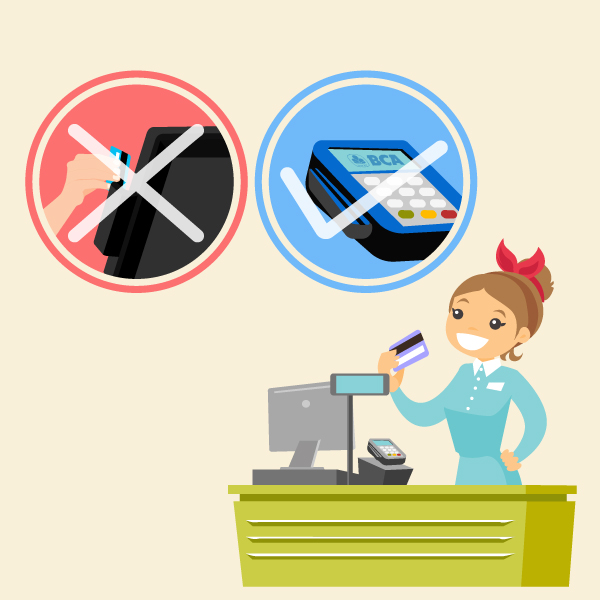

Have you ever heard about the double swipe practice? If you shop using a debit or credit card, and then the cashier swipes your card through the EDC machine and also the cash register, you must report that to us or the Bank of Indonesia (BI). This is because such practice may trigger the stealing of data and information contained in your debit or credit card.

Double Swipe Prohibition Based on the Bank Indonesia Regulation No.18/40/PBI/2016

- Customers' data stored in the debit/credit card can be misused and there have been many crimes related to the duplication of bank customers' data.

- The bank is the only authorized party to store customers’ data in order to maintain data security.

- Bank of Indonesia protects customers’ data stored in debit/credit cards.

Why is the "Double Swipe" Dangerous?

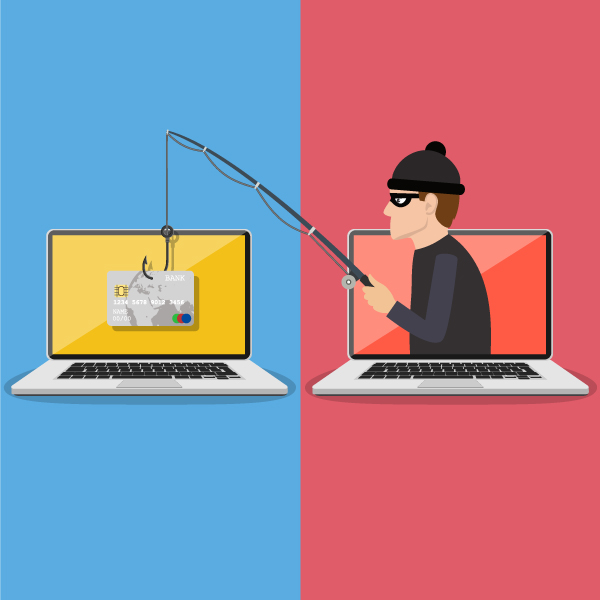

- Data stored in a magnetic stripe payment card is an unencrypted and unprotected package containing card number, customer name, expiration date, card verification value/card verification code, service code, and other confidential data.

- Double swiping has the potential to transfer all data, both general and confidential data, contained in the card into the store’s cash register system.

- Data stored in the store’s unstandardized computer system that is not monitored by any authority will be prone to stealing and misused by hackers.

- Selain itu, data lengkap dalam kartu kredit/debit dalam magnetic stripe bisa ditampilkan lengkap dalam kondisi tidak tersandikan (clear text) pada layar monitor kasir sehingga berpotensi dapat di capture untuk disalahgunakan.

- Furthermore, data contained in a credit/debit card’s magnetic stripe can be exposed in clear text form on the cashier’s monitor and thus can be captured and misused.

- If data fell into the wrong hands, people with bad intention can make illegal online payment transaction and withdraw money from the ATM using a clone card containing the customer’s data.

How To Prevent Double Swiping

- Ask the cashier if s/he is going to double swipe before making your transaction.

- If the cashier said, “Yes”, you should consider canceling your intention to shop there to protect your personal data.

- If your card was already double swiped, immediately report the store’s name to the Bank of Indonesia at (021) 131.

- Contact the debit/credit card issuer (HaloBCA 1500888) to report the double swiping incident.

- Immediately replace your magnetic stripe card (if you still use it today) with a card that uses chip technology.

That is all the information you need to know about double swiping. Let’s start to be careful, and protect your card from the risk of double swipes!