What do LLG and RTGS mean? LLG stands for Lintas Giro, which uses a clearing facility for transfers between one bank to another. Meanwhile, RTGS stands for Real Time Gross Settlement, which uses real time transfers between banks to speed up your transfer to the recipient's account. LLG and RTGS can also be done through BCA branch offices and Klik BCA. Cool, isn’t it?

Differences of LLG and RTGS in terms of amount, time, and cost

- Based on the amount, sending money via RTGS can be done with a higher amount of money (see table below)

- Based on time, RTGS can transfer money faster. Meanwhile, LLG sends money on the same day but takes a longer period of time.

- Based on cost, LLG and RTGS incur different costs at the branch office and on KlikBCA Bisnis (KBB)

| DESCRIPTION | LLG | RTGS |

|

Transaction amount (Rp) |

<=1 billion |

> 100 million |

|

Cost at the branch office (Rp) |

2.900 |

30.000 |

|

Cost on KBB (Rp) |

2.900 |

25.000 |

LLG and RTGS transactions on KlikBCA

By using KlikBCA, you can make transactions anytime, even in the middle of the night to be executed the next day. Great, right? KlikBCA transactions have a maximum limit of IDR 500 million per day per User ID, but KlikBCA Bisnis can make transactions with a limit that can be set according to the customer's desire.

Tutorial for LLG and RTGS via KlikBCA

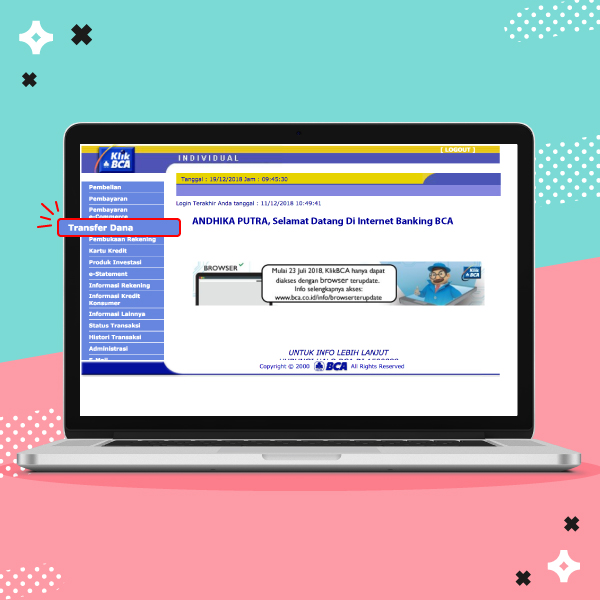

- After you log in, select Transfer Dana menu

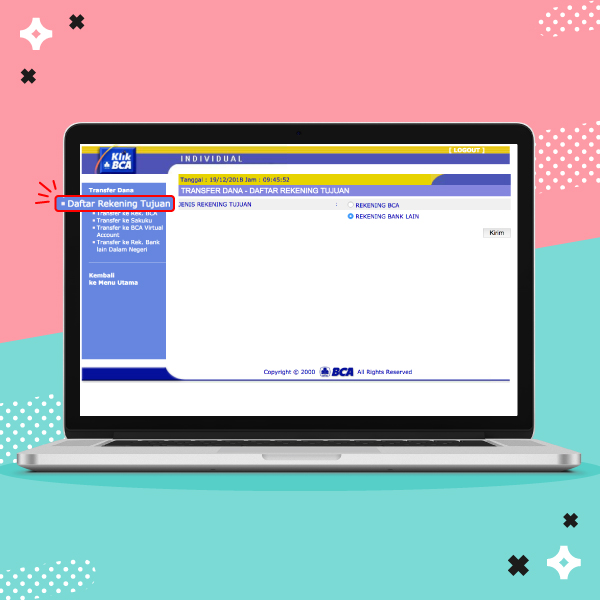

- Select Daftar Rekening Tujuan

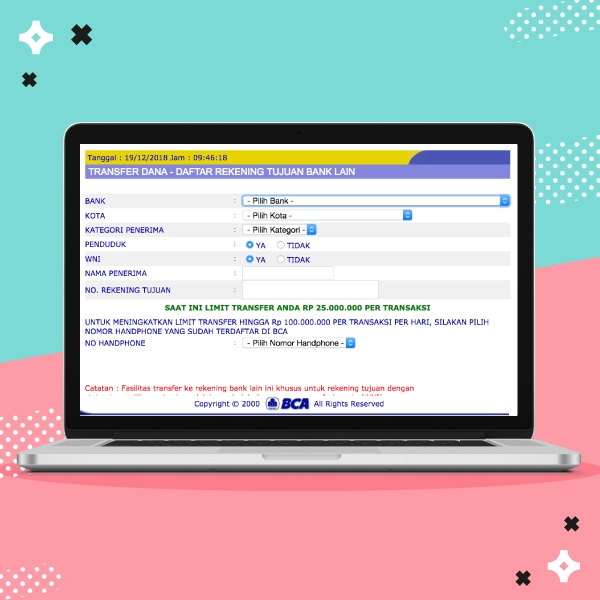

- Fill in the recipient data and input Key BCA response

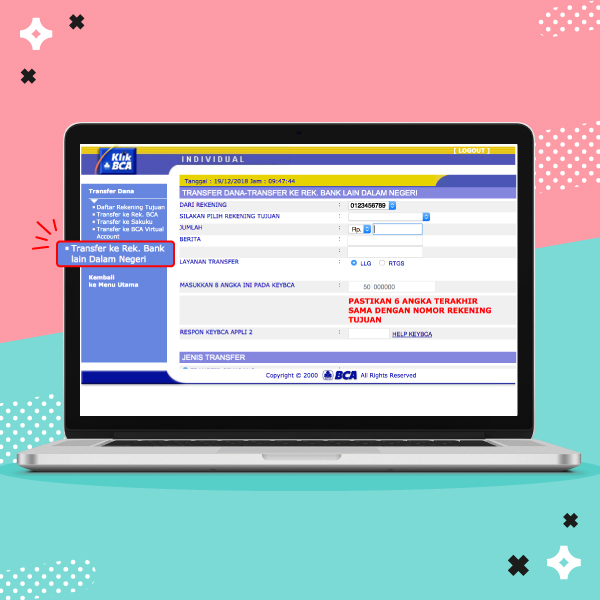

- Select Transfer to Rek. Bank Lain Dalam Negeri and enter the account number, transfer amount, and select LLG or RTGS transfer service.

Transfer to other banks via ATM and BCA mobile

BCA ATM and BCA mobile can both make transfers to other banks via the Prima network switching line. Although the transfer limit is limited according to the ATM card limit, transactions can be done anytime and anywhere in real time.

Tutorial to transfer to other banks via BCA mobile

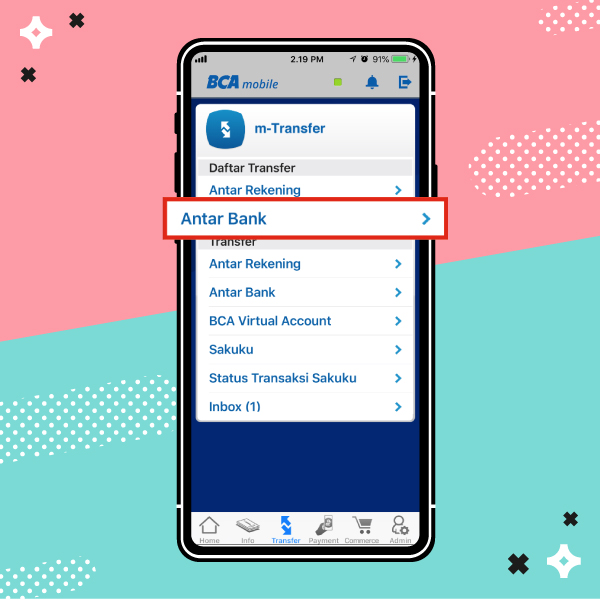

- Log in to BCA mobile and select “Transfer”

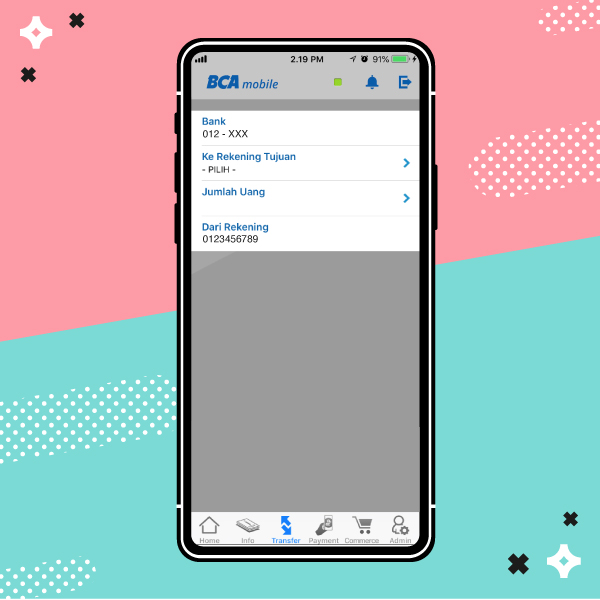

- Select Daftar Transfer Antar Bank, input the destination account (rekening tujuan)and destination bank (bank tujuan), and then click Send

- Input PIN, the destination account is already registered.

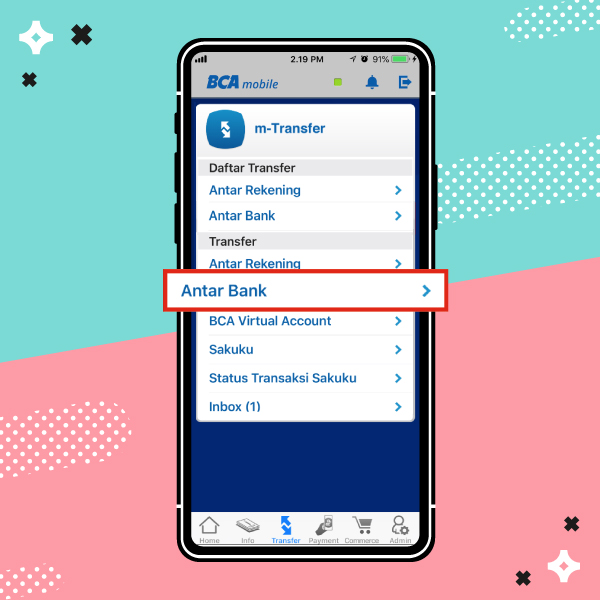

- Select Transfer Antar Bank

- Select the destination account, enter the amount of money, and click Send

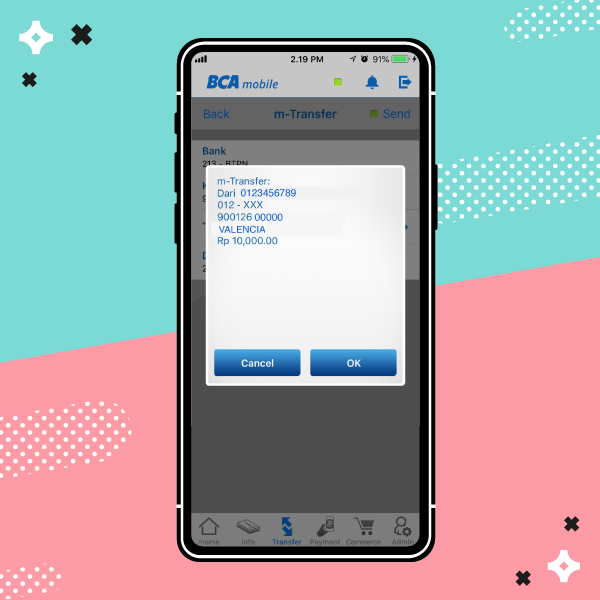

- Confirm the destination account and the transfer amount, if it is correct, click OK, enter PIN, and done!

Pretty easy, right? Now you know the differences between LLG and RTGS via BCA Branch/KlikBCA, as well as transfers between banks via ATM/BCA mobile. The secret is to adjust the transaction time to when the funds are needed. If the amount to be sent is still sufficient, it is recommended to transfer money via BCA mobile. It is more practical, simple and can be accessed anywhere. Good luck!

Want more information? Click here.