Almost everyone dreams of owning their own home. Many of them even already have a specific idea about what kind of house they’d like to own.

From the facade, the furniture, how the garden would look, even the small trinkets that they would use to fill and decorate their dream house.

And yet, the road to owning your dream home is not always easy.

They must consider aspects such as the land and building size, the location and distance to city center and their workplace, also the neighborhood and public facilities before deciding to buy the home.

And the most important thing, of course, is the price and the required mortgage (KPR) scheme.

Monthly mortgage installment is the combination of principal and interest. The credit tenor also affects the amount of interest. The longer the tenor, the bigger the interest that must be paid and vice versa.

The amount of installment and tenor length are two things that often decide whether or not to go h with the mortgage. through with the mortgage.

That’s why it’s important to know all the available mortgage options. Choosing the right mortgage program with smaller interest and a shorter tenure could be the key to owning your dream home.

One of the smarter and more efficient solutions is KPR CERDAS or Cicilan Efisien dengan Rekening Dana Simpanan (Efficient Installments with a Savings Account).

Getting to know more about KPR CERDAS

KPR CERDAS is a feature of BCA’s mortgage program that calculates the balance in your auto-debit savings account to reduce the portion of interest paid on your mortgage installments. Hence, your loan tenure will be shorter.

Furthermore, the larger your savings balance is, the lighter the interest you’ll have to pay. Which means, you’ll be able to pay off your mortgage faster!

What does the benefit of using KPR Cerdas looks like?

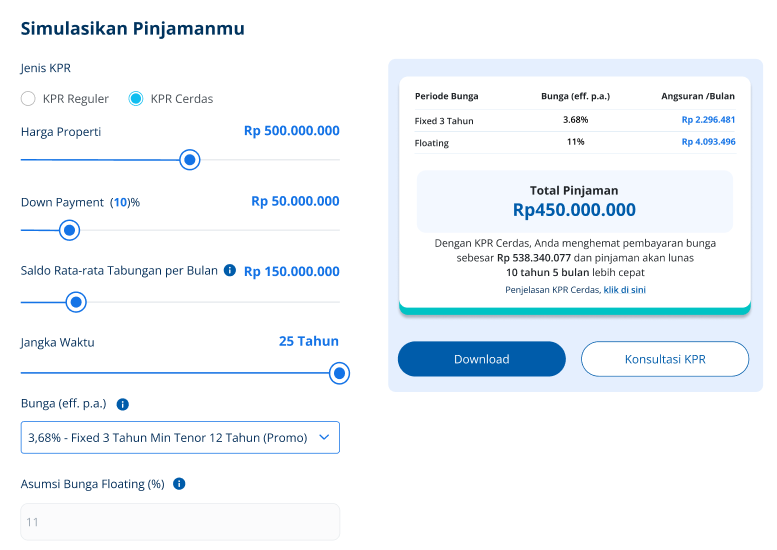

Let’s say you’ve found your dream home and applied for a mortgage of Rp450 million using KPR Cerdas. Along with that, you’re placing Rp150 million in your savings account throughout the loan tenure. Here’s a simulation of how KPR Cerdas works:

Installments above are only for illustration purposes

With this setup, you would save Rp538 million in interest payments and pay off your mortgage 10 years and 5 months earlier. Smart and efficient, isn’t it?

Now is the time to apply for KPR Cerdas BCA at your nearest BCA Branch by contacting a Customer Service Officer (CSO), RO/(AO, or other branch staff. You can also directly contact your preferred developer/broker who is partnered with BCA’s mortgage program.

Learn more about KPR Cerdas BCA at bca.id/kprbcacerdas or by visiting the nearest BCA Branch. It’s time to take the easier and smarter first step toward owning your dream home with KPR Cerdas BCA!