*Update : 1 Mar 2024

Everyone has their own financial objectives. To achieve these objectives, you need a strategy to divide your financial objectives into 3 (three) parts based on the investment period, namely short-, medium-, and long-term. Each period has a different strategy.

- Short-term objective

Objectives can usually be achieved in less than 1 (one) year. A short-term strategy is to use funds you can access anytime you need, such as Money Market Mutual Funds or RDPU and short-term instruments (< 1 year deposit and obligation). RDPU offers an optimal return with relatively low risk, liquid, and is more protected from the volatility of mutual fund's price change.

- Medium-term objectives

Objectives can usually be achieved in 1-5 years. You can use Fixed Income Mutual Funds (RDPT) or Mixed Mutual Funds (RDC) that offer higher returns compared to RDPU. RDPT invests in debt securities instruments for both the government and companies, while RDC invests up to 79% in money market instruments, debt securities, and/or share/equity securities.

- Long-term objectives

Objectives can usually be achieved in more than 5 (five) years. It is suggested to monitor your expenses and consistently set aside your income, and you should choose investment products that can accelerate your long-term financial objectives, but are still adjusted to your risk profile. An equity fund (RDS) is an investment of choice for investors with an aggressive risk profile who can accept the high risk and long-term investment period.

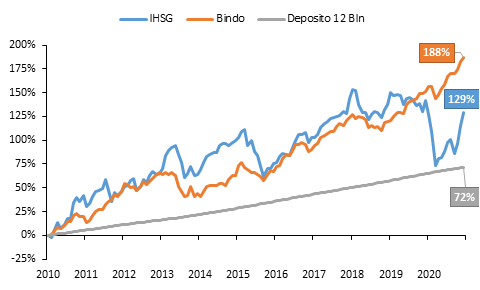

Historical data has showed different results from different instruments:

- A 12 month deposit (after tax) results in 72% profit

- Bindo, the government bonds index using Rupiah, also known as the Fixed Rate series, results in 188% profit

- IHSG, the stock index in Indonesia, results in a total return of 129%

Tips on achieving your financial objectives:

- Start by planning and realizing the easier ones. Once you have achieved your target, increase your financial objectives gradually.

- Set a target and evaluate your target periodically. For medium-term objectives, evaluate them once a year. A target will help you monitor the process and motivate you to achieve your financial objectives.

- Be disciplined in fulfilling your financial objectives to manage your finance and monitor the development

Choose investment instruments and strategies ideal for you, so you will not be burdened by them. Now, which one suits you?

To help with investment strategies in mutual funds and bonds, use Investment feature in myBCA which can be downloaded on the Appstore and Playstore.

Writer: Theodorus Nico, Investment Specialist Bahana TCW

Disclaimer:

Mutual Fund is a product of the capital market and not a product of PT Bank Central Asia Tbk. (BCA) and BCA are not responsible for any claims and risks related to the management of the Mutual Fund portfolio. Investments in Mutual Funds are not part of third-party deposits with BCA so they are not guaranteed by BCA and are not included in the scope of the object of the government guarantee program or deposit insurance. BCA only acts as a selling agent for Mutual Funds. Investment in Mutual Funds contains risks that allow investors to lose part or all of their invested capital. Mutual Fund's past performance is not a guarantee of future performance. Prospective investors are required to read and understand the Mutual Fund prospectus before deciding to invest through the purchase of Mutual Fund participation units.

PT Bahana TCW Investment Management has obtained a license as an investment manager from the Financial Services Authority (OJK) and is supervised by the OJK in carrying out its business activities.