Environmental Friendly Business Activities

Enhancing the Sustainable Finance Portfolio

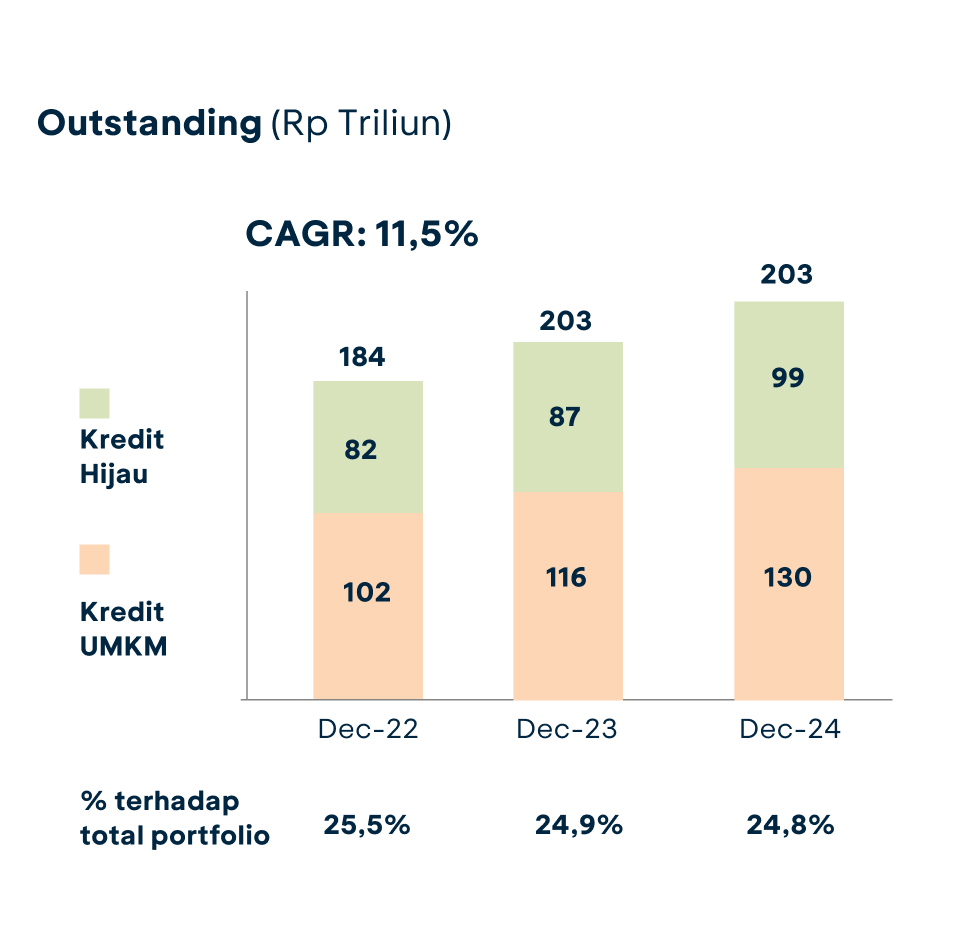

Total Sustainable Financing Portfolio IDR 229 trillion, increased12.5% compared to last year's IDR 203 trillion. This achievement is higher than the KKUB target of 9%. Sustainable Financing portfolio consists of green financing at 43.2% and MSMEs portfolio at 56.8%. Total Sustainable financing portfolio is equivalent to 24.8% of the bank's total portfolio in 2024.

Green Financing Portfolio

Rp99 trillion

↑ 13,5% YoY

MSMEs Portfolio

Rp130 trillion

↑ 11,9% YoY of the total composition of the KKUB Outstanding Portfolio

Outstanding Financing with SLL Scheme

BCA has also developed a Sustainability Linked Loan (SLL) scheme. Under this SLL scheme, BCA collaborates with debtors to established Key Performance Indicators (KPIs) and Sustainability Performance Targets (SPTs) that are aligned with the debtors' main business operation. With this scheme, debtors will receive incentives if they meet a series of agreed SPTs.

Rp1.003 billion

Rp319 billion

Financing for Environmentally Sustainable Business Activities

Renewable Energy

Energy Efficiency

Pollution Prevention and Control

Sustainable Natural Resources and Land Use

Eco-Efficient Products

Sustainable Transportation

Green Building

In credit application process, BCA has implemented several policies and procedures to ensure that business activities are in line with financing responsible by:

- Implementing sectoral credit policies for sectors that have the potential for high risk of environmental damage.

- Issuing an exclusion list as a risk appetite guideline while still considering the risk aspects of each sector.

Electric Vehicle (EV) Financing

Green Financing

BCA supports transition to low-carbon transportation through the financing of electric vehicles (EV) in 2024 amounting to Rp 2.348 billion, an increase of around 84.2% compared to the previous year.