Category Edukatips :

Sitecore.Data.Items.Item

You can open a BCA account online from e-commerce and e-wallet application for various types of BCA accounts by completing the documents and requirements for opening a BCA account.

It’s now easier than ever to open a BCA account online. You can even open a new account using the e-commerce and e-wallet app.

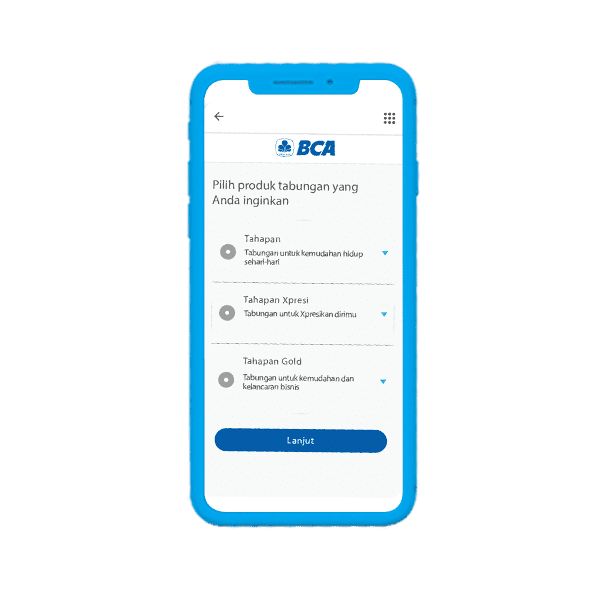

Types of BCA Accounts that You Can Open Online

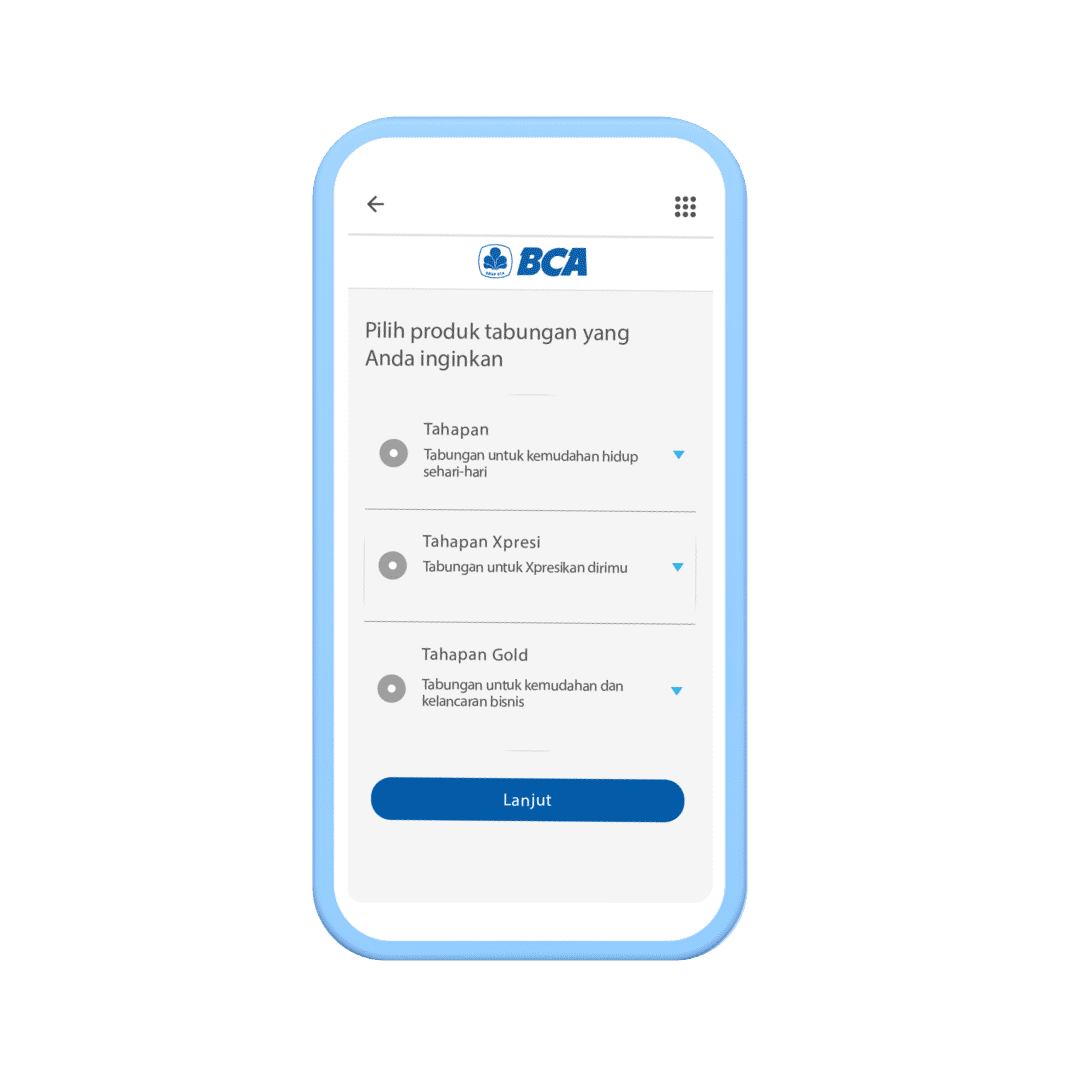

You can choose the type of BCA account on Bayarind according to your needs. Different types of BCA accounts can be adjusted according to their purpose of use.

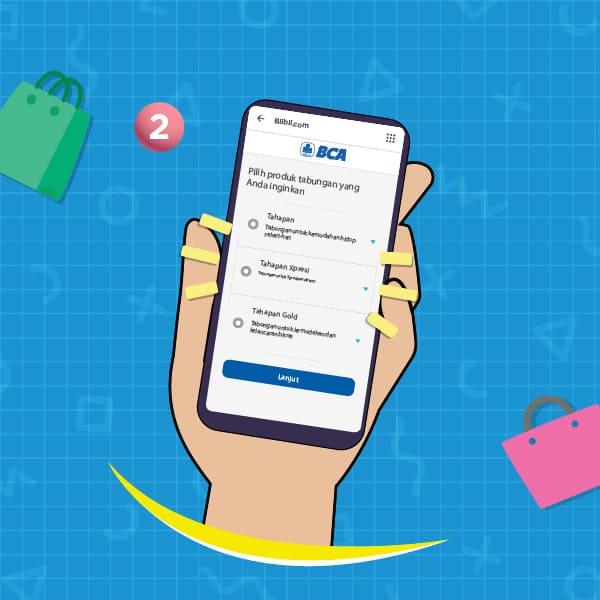

When opening a BCA account, there are several types of BCA accounts that you can choose according to your needs and purposes for using the account. Here are the types of BCA accounts that you can choose from.

1. Tahapan

Tahapan BCA is the most commonly used account type for personal needs and is a Rupiah-denominated savings account. Tahapan BCA users can enjoy cash withdrawal facilities at thousands of BCA ATMs, ATM Prima network, and Mastercard network worldwide. In addition, Tahapan BCA also comes with BCA Debit which works as an ATM and debit card and offers internet banking facilities such as KlikBCA, BCA mobile, and myBCA.

2. Tahapan Xpresi BCA

Tahapan Xpresi is a BCA account that comes with more than 50 unique card designs for your unique self. Furthermore, Tahapan Xpresi BCA users can also access facilities at BCA ATMs, KlikBCA, BCA mobile, and myBCA.

3. Tahapan Gold

For users with business needs, you can also open a Tahapan Gold BCA account. This savings product is intended for business needs that help businesses run smoothly while protecting the credibility of business transactions.

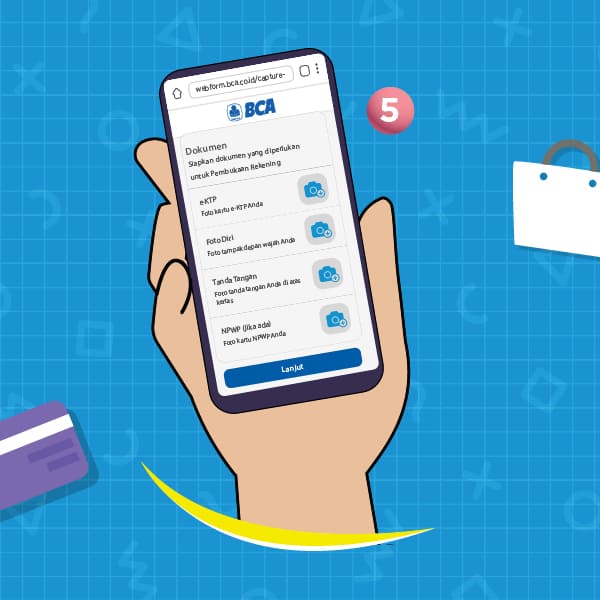

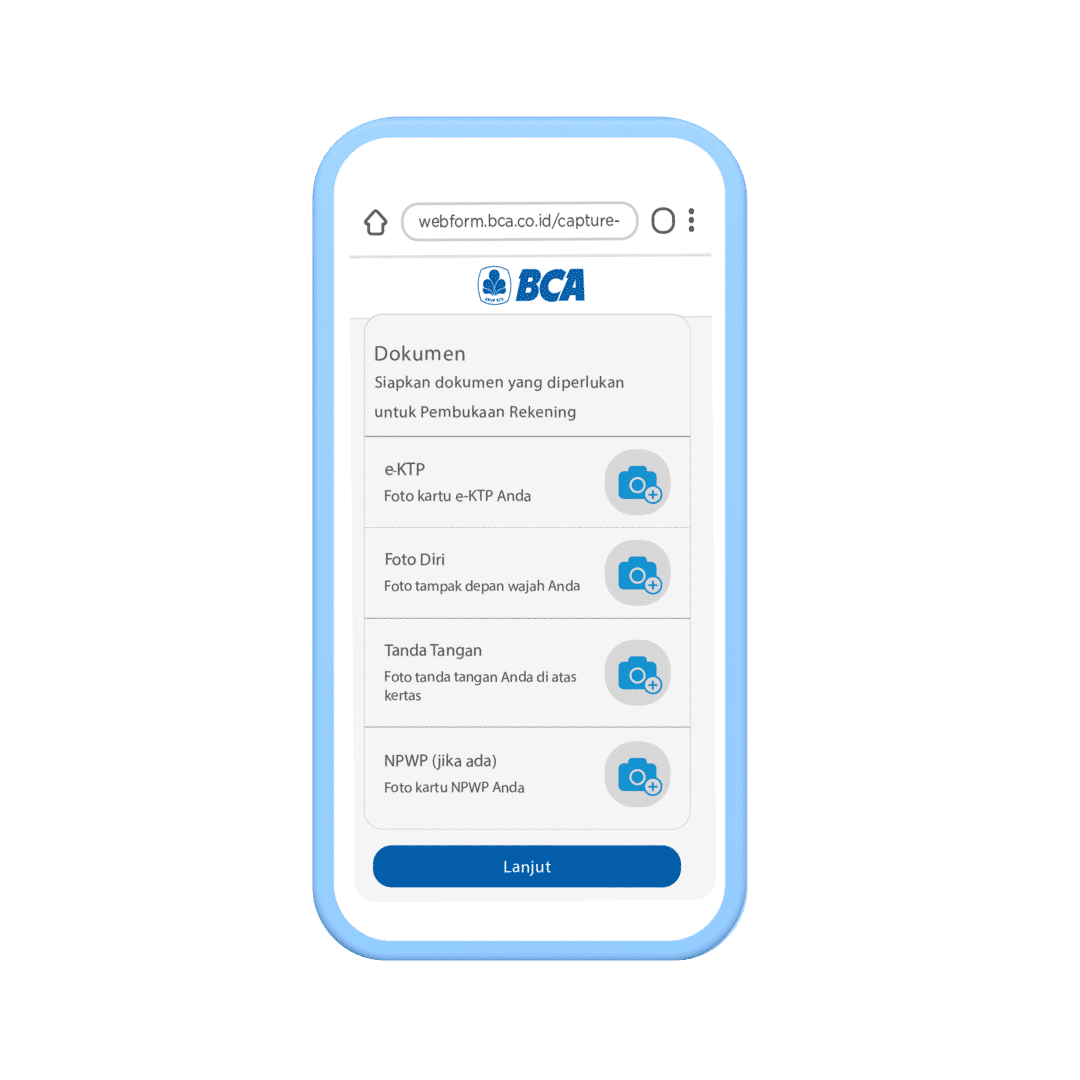

Terms of Opening BCA

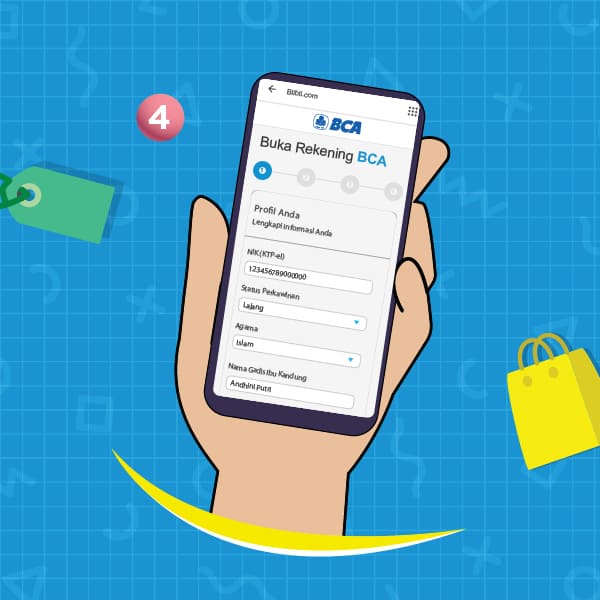

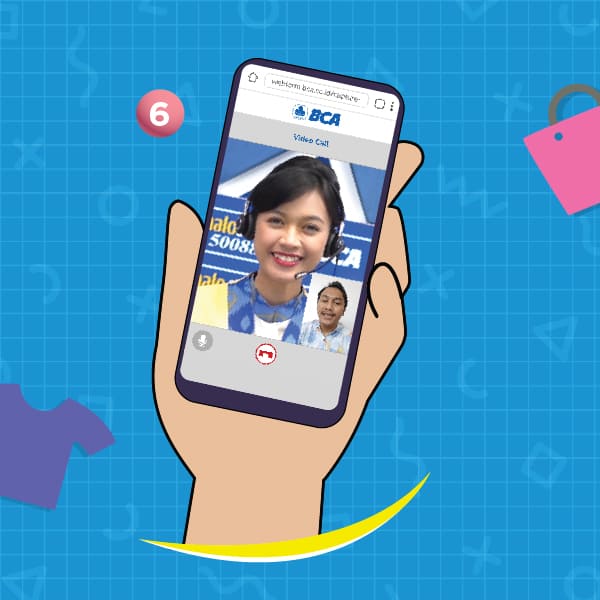

There are several essential documents that you need to prepare in order to open a BCA account. Then, you need to go through a verification process via a video call with a Halo BCA customer service officer. To open a BCA savings account online, you need to provide the following documents.

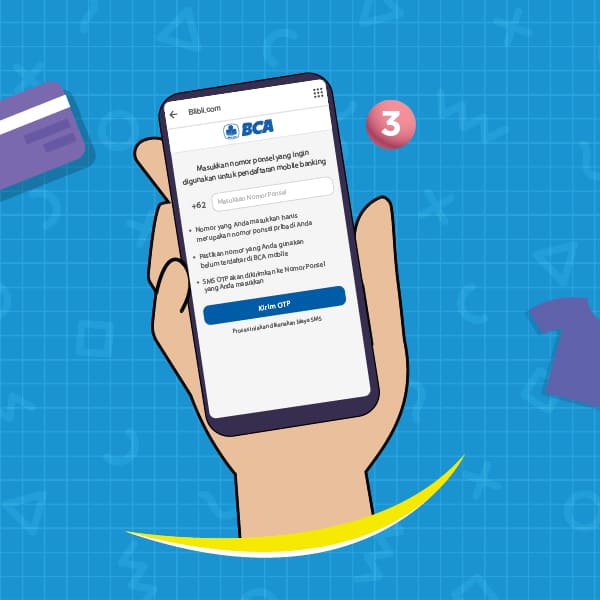

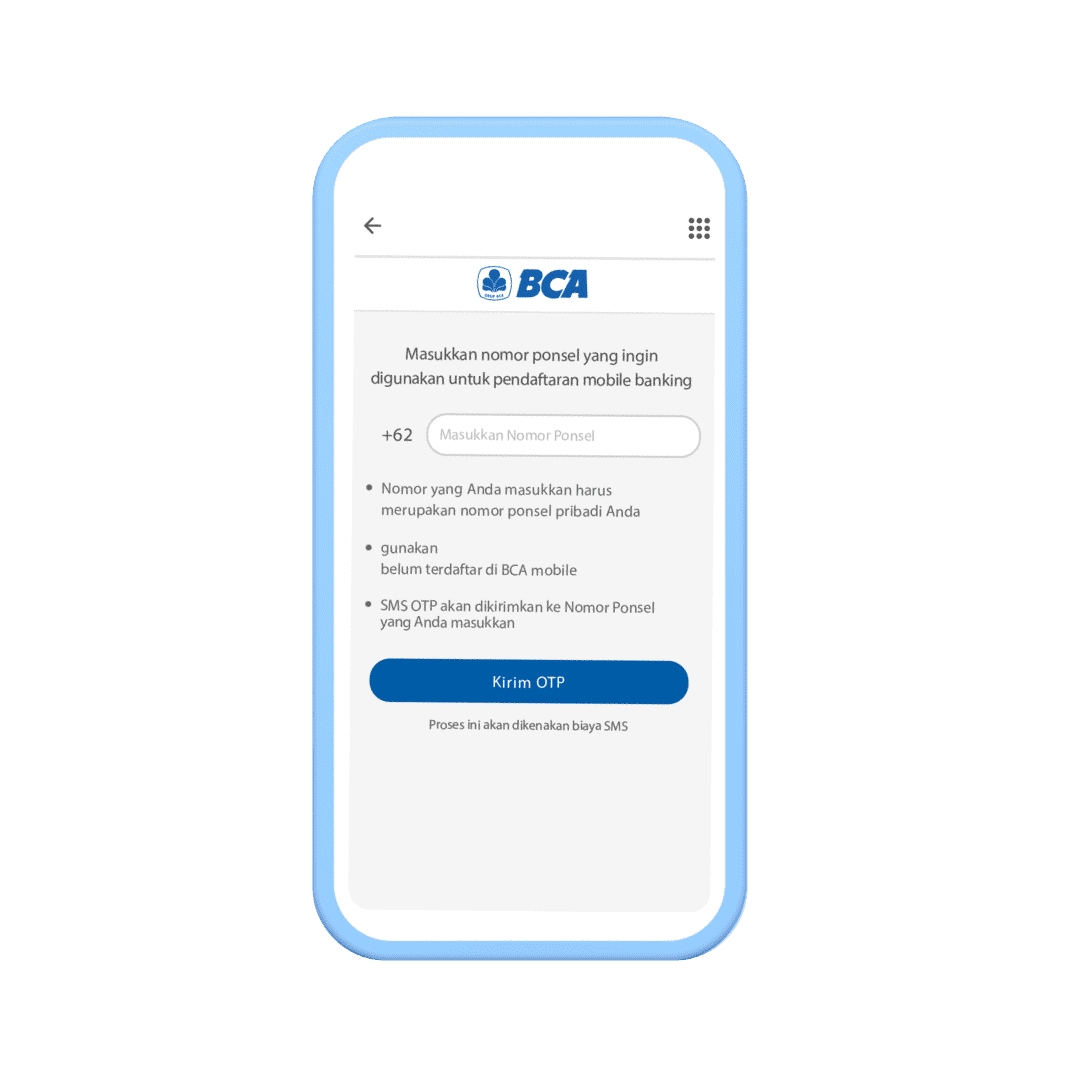

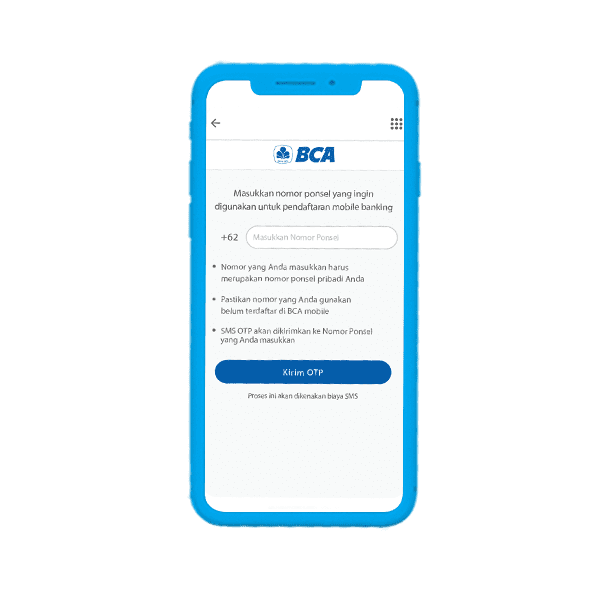

1. Have an Active Mobile Number

Make sure that you register an active mobile phone number as it is used for mobile banking registration. If you have more than one mobile phone number, it’s best to use the main number because it needs to be verified through a video call with a Halo BCA customer service officer. Also make sure that the number has not been registered with BCA’s m-banking service.

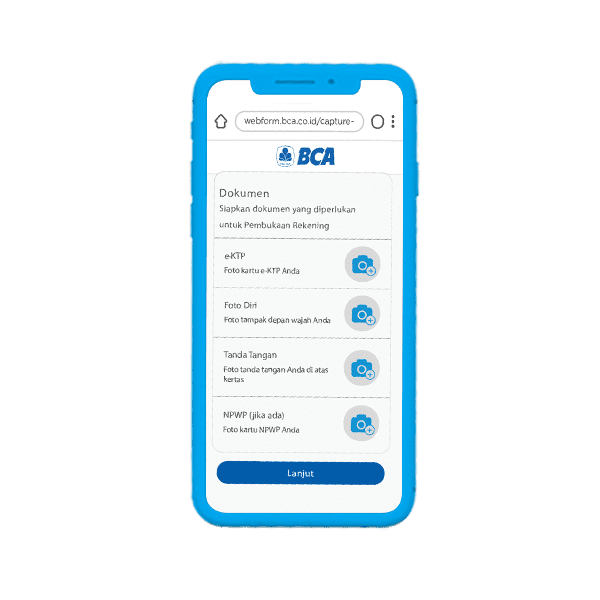

2. Attach a photo of KTP

You also need to provide KTP (ID Card) as one of the required documents. You only need to take a photo of your KTP for submission and verification. Make sure the photo of the KTP is not cropped and that the writing is legible.

3. Take a Selfie

When opening an account via Bayarind, you will also need to take a photo of yourself. Your photo needs to be a clear front-facing photo (like the official photo on your ID card) with a plain background.

4. Signature Photo

Have your signature read on plain white paper as well. It is better to sign using black ink. Make sure the photo of the signature is visible.

5. NPWP Photo (if any)

As a complementary document, the NPWPcan also be attached as a document for opening an account. You can take a photo of the NPWP the same way you take a photo of your ID card.

If you have determined the type of account that is suitable and in accordance with your needs and have prepared the necessary documents. Follow the steps below to be able to open a BCA account through an e-commerce or e-wallet application.

Opening a BCA Account via Blibli

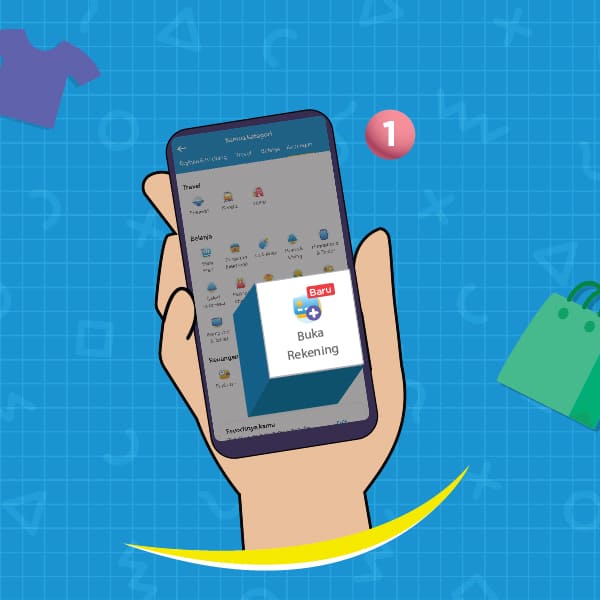

- Click the “Buka Rekening” on Blibli app

- Select a Banking Product you wish to open

- Enter a Mobile Phone Number that has not been registered with BCA mobile and verify the OTP Codesent via SMS

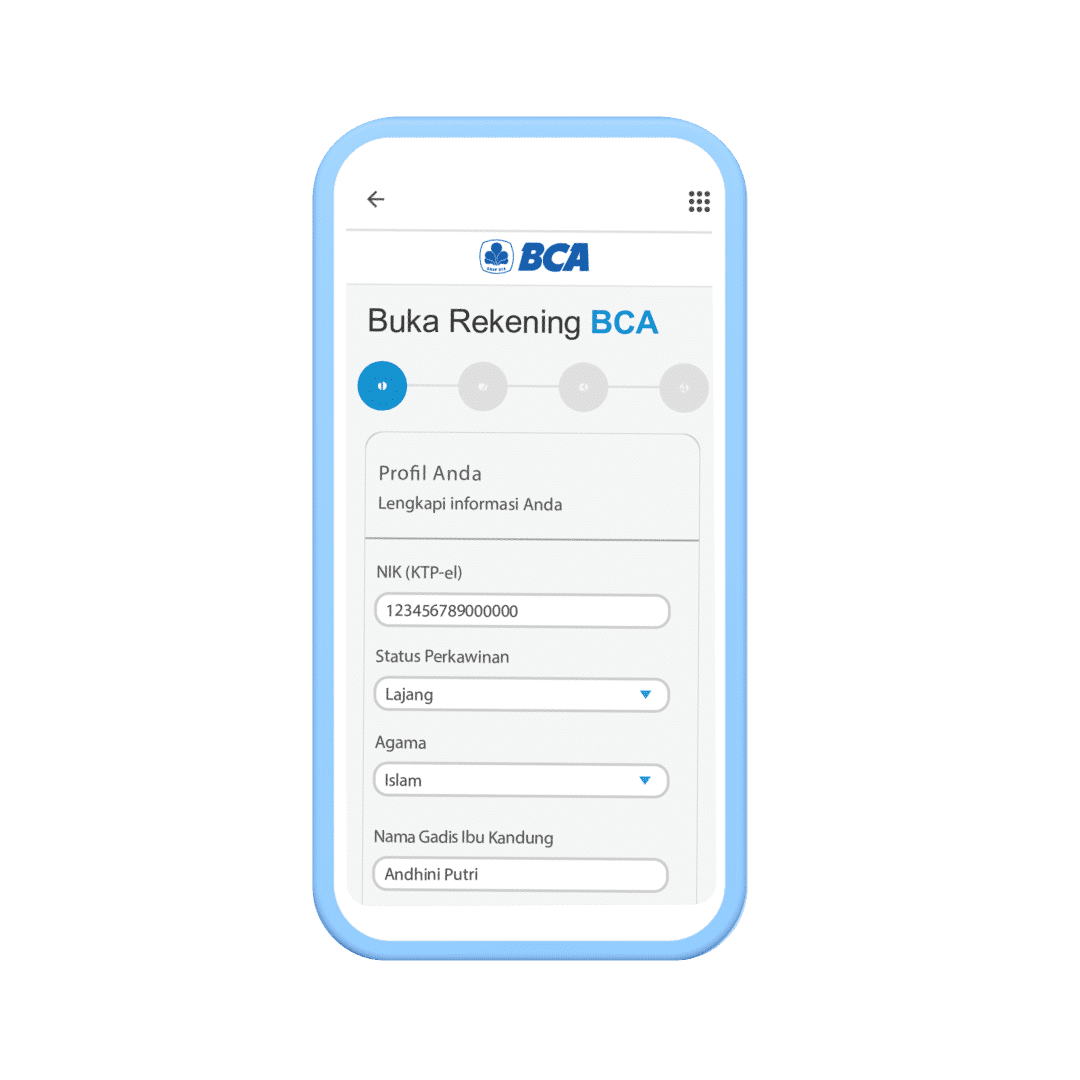

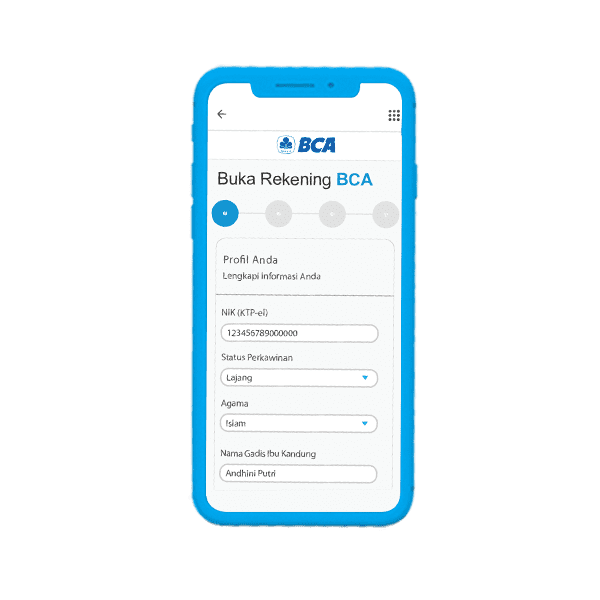

- Fill out the Form and other Supporting Data

- You will be directed to Google Chrome (Android)or Safari (iOS) browser to upload documents

- Make a video call with Customer Service BCA

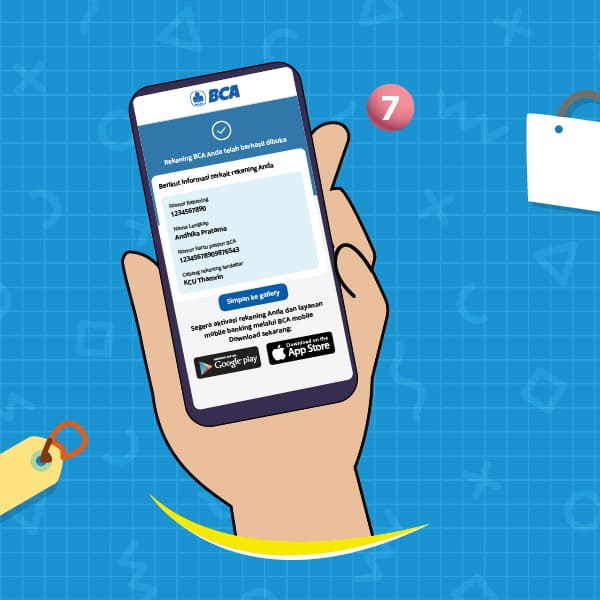

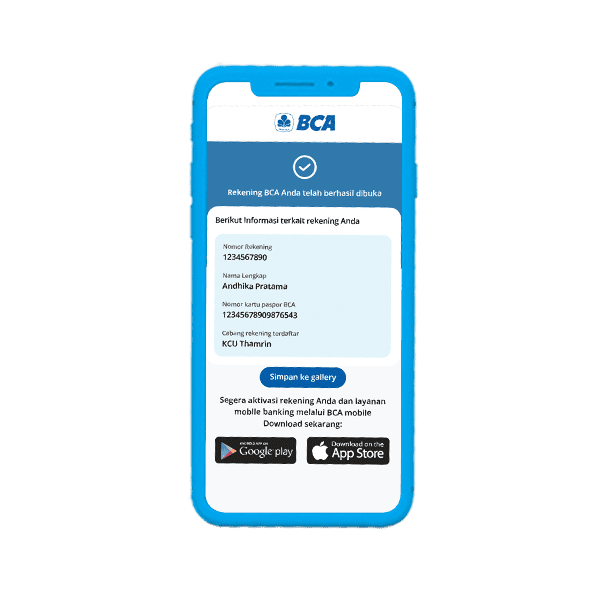

- Account opening is complete and you will receive a Notification Email.

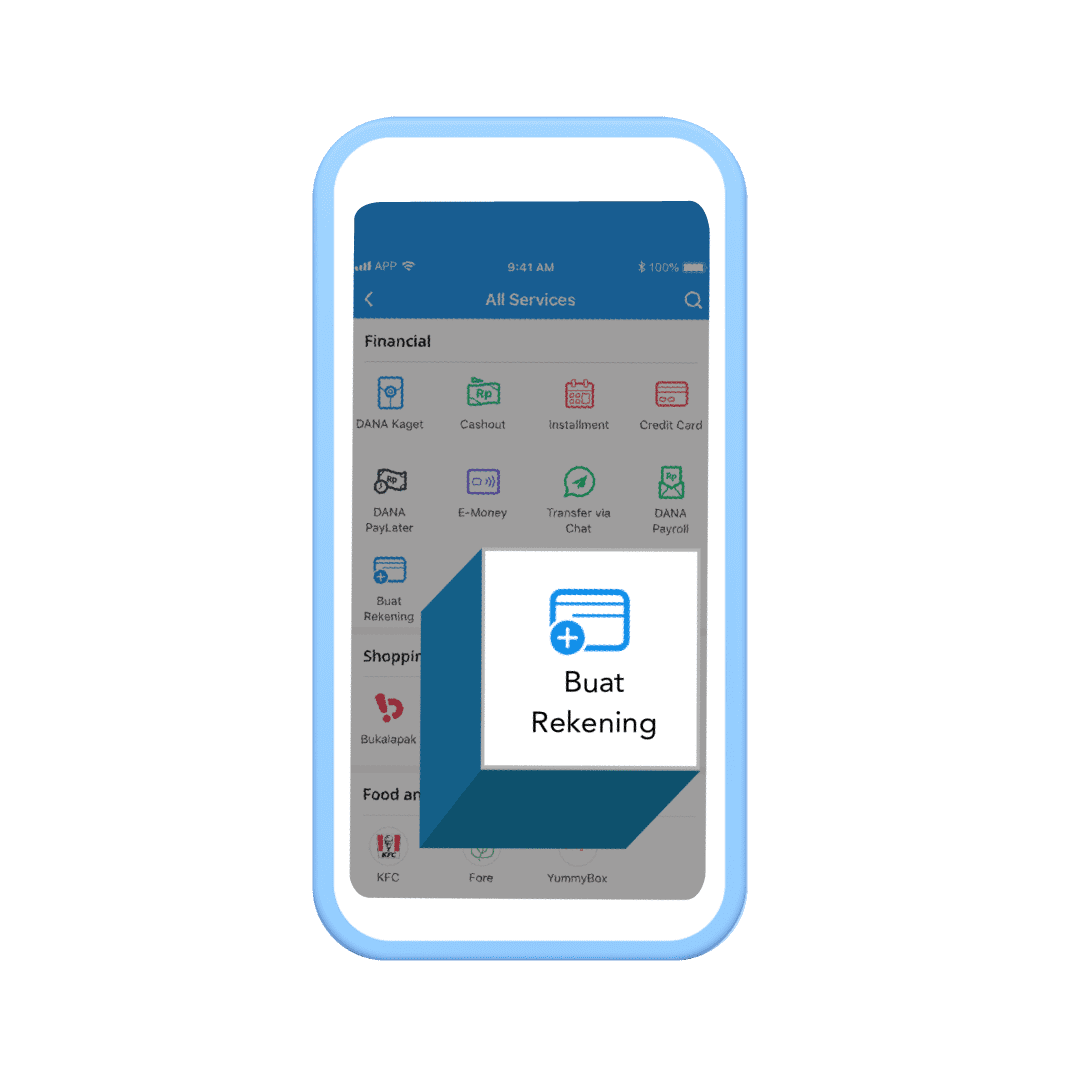

Opening a BCA Account via Dana

- Click the “Buka Rekening” on Dana app

- Select a Banking Product you wish to open

- Enter a Mobile Phone Number that has not been registered with BCA mobile and verify the OTP Codesent via SMS

- Fill out the Form and other Supporting Data

- You will be directed to Google Chrome (Android)or Safari (iOS) browser to upload documents

- Make a video call with Customer Service BCA

- Account opening is complete and you will receive a Notification Email

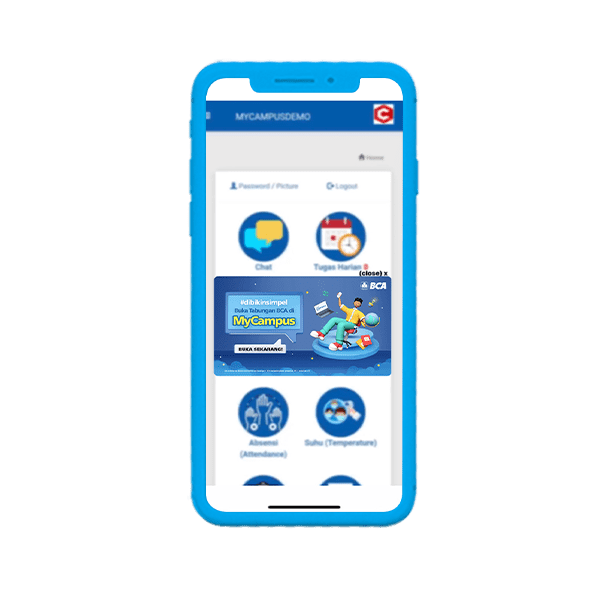

Opening a BCA Account via MyCampus

- Click the “Buka Rekening” on myCampus app

- Select a Banking Product you wish to open

- Enter a Mobile Phone Number that has not been registered with BCA mobile and verify the OTP Codesent via SMS

- Fill out the Form and other Supporting Data

- You will be directed to Google Chrome (Android)or Safari (iOS) browser to upload documents

- Make a video call with Customer Service BCA

- Account opening is complete and you will receive a Notification Email

Opening a BCA Account via Bayarind

If you have determined the type of BCA account you want, be sure to prepare the documents required for account opening. Here’s how to open a BCA account via the Bayarind app.

- Open the Bayarind app, select the “Buka Rekening” menu

- Select the savings product you want and according to your needs

- Enter the phone number that will be used for mobile banking registration

- Fill out your data correctly

- Complete the required documents

- As part of the verification process, make a video call with a Halo BCA customer service officer

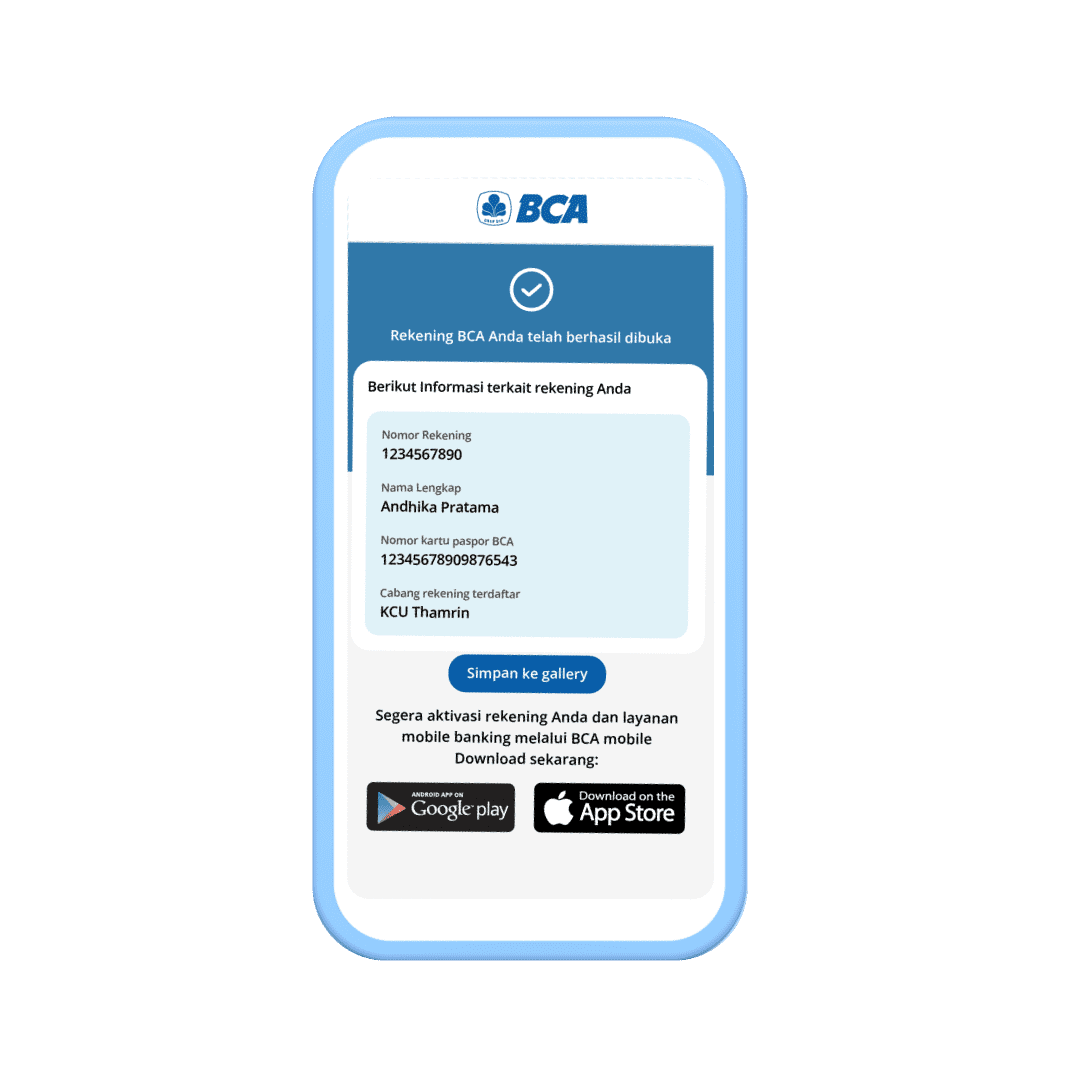

- If the verification has been done, you will get a notification that a BCA account has been successfully opened.

Now you can open a BCA savings account while shopping, studying, or making payments via Blibli, MyCampus, DANA and Bayarind. Wait no more! Open a BCA account now.

Don’t forget to share this information with your friends, Goodfriends.